Suppose a bank has $100 million in checking account deposits with no excess reserves and the required reserve ratio is 10 percent. If the Federal Reserve reduces the required reserve ratio to 4 percent, then the bank can make a maximum loan of

A) $0. B) $4 million. C) $6 million. D) $10 million.

C

You might also like to view...

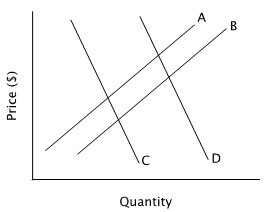

Refer to the accompanying figure. A decrease in supply is represented by a shift from:

A. curve C to curve D. B. curve A to curve B. C. curve D to curve C. D. curve B to curve A.

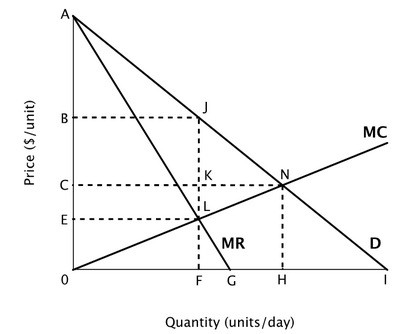

Suppose the accompanying figure shows the demand curve, marginal revenue curve and marginal cost curve for a monopolist. The profit-maximizing price for this monopolist to charge is:

The profit-maximizing price for this monopolist to charge is:

A. A. B. E. C. C. D. B.

When a country has a lower opportunity cost in producing a good than any other country,

A. It has favorable terms of trade in producing the good. B. It necessarily has an absolute advantage in producing the good. C. Production possibilities are no longer limited. D. Consumption possibilities will increase with specialization and trade.

The large-number-of-sellers condition of perfect competition is met when

A. there are more sellers than buyers in the market. B. there are more than 50 firms in the industry. C. there are more than 100 firms in the industry. D. each firm is so small relative to the total market that no single firm can influence the market price.