At the conclusion of its meeting on January 27, 2016, the Federal Open Market Committee released a statement that included the following sentence: "Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and return to 2 percent inflation ." What is the significance of this statement?

What will be an ideal response?

FOMC members had concluded that economic conditions justified keeping nominal interest rates low in order to keep the real interest rate down to raise aggregate expenditures so as to close the recessionary output gap and raise inflation. But, having raised their interest-rate target at their meeting six weeks earlier, and with inflation forecast to rise to 2 percent within two year, observers were largely in agreement that the next move in the target rate would be up.

You might also like to view...

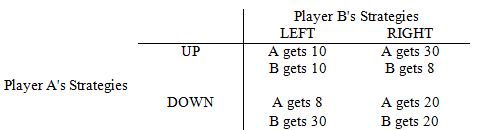

Refer to Game Matrix IV. The Nash Equilibrium for the game is

Game Matrix IV

The following questions refer to the game matrix below.

Player A can play the strategies UP and DOWN and Player B can play the strategies LEFT and RIGHT.

a. UP, LEFT

b. UP, RIGHT

c. DOWN, LEFT

d. DOWN, RIGHT

Business cycles are recurring periods of economic growth and decline in an economy's real GDP

a. True b. False Indicate whether the statement is true or false

The consumption function has two components: (1) consumption that depends on the level of income and (2)

a. permanent consumption b. transitory consumption c. autonomous consumption d. automatic consumption e. expected consumption

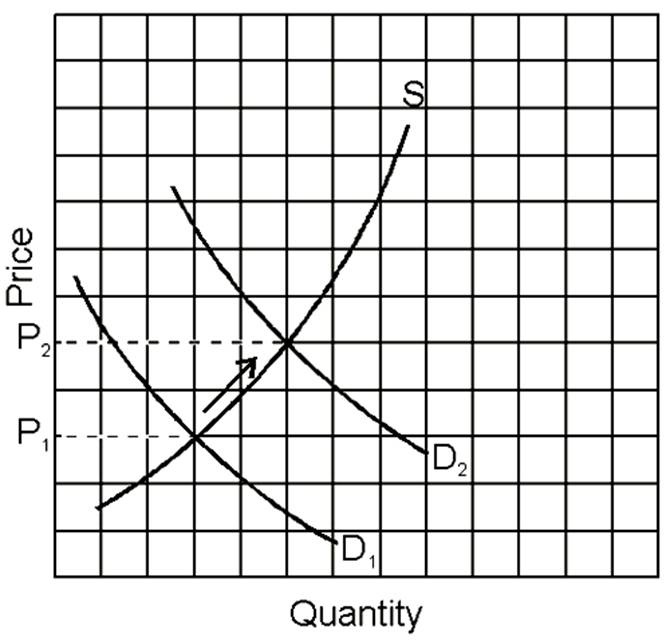

This graph shows what causes

A. cost-push inflation.

B. demand-pull inflation.

C. neither cost-push nor demand-pull inflation.