In planning for a Fiscal year, which of the following is supposed to happen first?

A. an appropriations bill

B. a budget bill

C. a continuing resolution

D. a Presidential veto

Answer: B

You might also like to view...

The deadweight loss of a tax

A) is the transfer of income from households to the government. B) determines the incidence of a tax. C) is part of the total burden of a tax. D) is greater than the total burden of a tax. E) equals the tax revenue collected by the government.

An agricultural corn market faces a positive supply shock due to a beneficial rainy season and the use of new genetically modified seeds. As a result, farmers face the largest crop harvest in decades

Which answer below explains how a farm could actually go bankrupt under this scenario. A) The elasticity of supply for corn is elastic such that a positive shock reduces total revenue. B) The demand for corn is inelastic such that a positive supply shock reduces total revenue. C) An inelastic demand curve will cause revenue to fall because price decreases by more than the increase in quantity demanded. D) B and C

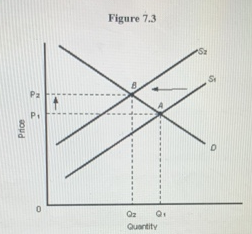

Refer to Figure 7.3. Which of the following explains the shift in the supply curve from S1 to S2?

a. Discoveries of natural gas

b. Wage concessions by union members

c. Businesses reducing their profit margins

d. Decreases in oil supplies as experienced in the 1970s

e. Increased foreign demand for domestic products

The relationship between the number of hours you study and your economics score is linear.

Answer the following statement true (T) or false (F)