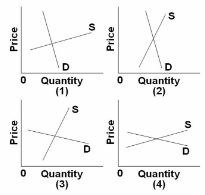

In which of the given market situations will the largest portion of an excise tax of a specified amount per unit of output be borne by buyers?

A. 4.

B. 3.

C. 1.

D. 2.

C. 1.

You might also like to view...

Suppose Canada has a population of 30 million people and a labor force participation rate of 2/3. Furthermore, suppose the natural rate of unemployment in Canada is 7%. If the current number of unemployed people is 2 million people, what can we conclude about Canada's economy?

A. There is no frictional unemployment present in the economy. B. The unemployment rate is above the natural rate of unemployment. C. The unemployment rate is below the natural rate of unemployment. D. There is no cyclical unemployment present in the economy.

When a firm ignores external costs:

A. it fails to maximize its profits. B. it is willing to produce too little of the good at the given price. C. the good is priced too cheaply in equilibrium. D. it also ignores external benefits.

As more firms are attracted to an industry, the supply curve can be expected to shift to the right

a. True b. False Indicate whether the statement is true or false

If a market basket was defined in 2014 and it cost $10,000 to purchase the items in that basket in 2014, while it cost $11,000 to purchase those identical goods in 2015, then the inflation rate from 2013 to 2014 is

A. (100-90.9)/100*100%=9.1%. B. (110-100)/100*100%=10%. C. (100-100)/100*100%=0%. D. unknown given this data.