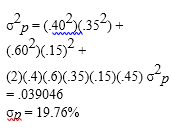

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 35%, while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is .45. Stock A comprises 40% of the portfolio, while stock B comprises 60% of the portfolio. The standard deviation of the return on this portfolio is _________.

A. 23%

B. 19.76%

C. 18.45%

D. 17.67%

B. 19.76%

You might also like to view...

Computer equipment was acquired at the beginning of the year at a cost of $57,000 that has an estimated residualvalue of $9,000 and an estimated useful life of 5 years. Determine the second-year depreciation using the straight-line method

a. $13,200 b. $19,200 c. $9,000 d. $9,600

In order to impress her date, Shaquita has dressed especially nicely and has sprayed on a bit of her favorite cologne. Which channels is she using to send a message to her date?

A. visual and auditory B. auditory and tactile C. olfactory and tactile D. visual and olfactory

Budgetary slack is frequently found in imposed budgets

Indicate whether the statement is true or false

What are the main functions of the business plan?

What will be an ideal response?