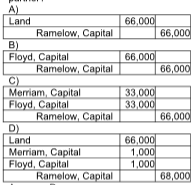

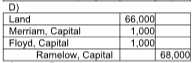

Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land with a market value of $66,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:

![]()

Explanation: Total Capital = $51,000 + $19,000 + $66,000 =$136,000

Ramelow Capital = $136,000 / 2 = $68,000

Land debit is $66,000.

$68,000 - $66,000 = $2,000 bonus to new partner.

$2,000 bonus to new partner is distributed to old partners in 50/50 ratio.

You might also like to view...

List some of the marketing trends that are likely to emerge in the near future

What will be an ideal response?

At the beginning of 2018, Uptown Travel Company has the following account balances:

Accounts receivable $45,000 (Debit) Allowance for Bad Debts $6000 (Credit) During the year, credit sales were $850,000. Cash collected on credit sales was $770,000, and $17,000 was written off. Uptown uses the aging-of-receivables method to record bad debts expense. The amount estimated as uncollectible was $26,000. The amount of Bad Debts Expense for 2018 is _______ A) $37,000 B) $26,000 C) $11,000 D) $9000

In order to have a harmonious organizational environment, one must ______.

A. understand the differences and similarities between workers B. only focus on the things that make us different from one another C. take many different diversity classes D. focus on self-leadership

On a balance sheet, what items normally are included in Cash?