Suppose Ernie gives up his job as financial advisor for P.E.T.S., at which he earned $30,000 per year, to open up a store selling spot remover to Dalmatians. He invested $10,000 in the store, which had been in savings earning 5 percent interest. This year's revenues in the new business were $50,000 . and explicit costs were $10,000 . Calculate Ernie's economic profit

a. $10,000

b. $50,000

c. $20,000

d. $40,000

e. $9,500

E

You might also like to view...

When compared to a perfectly competitive market, a single-price monopoly with the same costs produces ________ output and charges ________ price

A) a larger; a lower B) a smaller; a lower C) the same; a higher D) a smaller; a higher E) a smaller; the same

While you and your roommate are eating your nightly Hamburger Helper meal, your roommate says "I'll never eat Hamburger Helper again once I graduate and start making some real money!" In your roommate's eyes, Hamburger Helper is currently

A) a normal good. B) an inferior good. C) a bad. D) a waste of his money.

Payments from government accounts to individuals for programs that do not involve a purchase of goods or services are called:

A. fiscal policy. B. grants. C. transfer payments. D. discretionary funds.

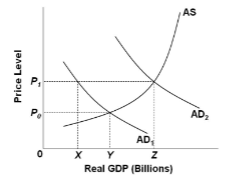

Refer to the figure. Suppose that the economy is currently operating at the intersection of AS and AD 2 , and that the full-employment level of output is Y. If the government wants to move the level of real GDP back to Y and reduce demand-pull inflation, in the presence of a ratchet effect, it should:

A. reduce taxes or increase government spending.

B. enact a contractionary fiscal policy that will shift aggregate demand left to AD 1 .

C. enact a contractionary fiscal policy that will shift aggregate demand to the left, but not as far as AD 1 .

D. enact a contractionary fiscal policy that will shift aggregate demand to the left, farther left

than AD 1 .