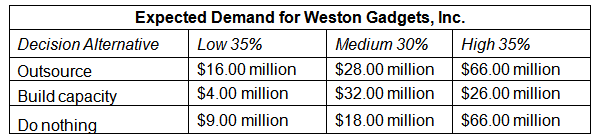

Refer to the data on Expected Demand for Weston Gadgets, Inc. For the various demand scenarios and their associated probabilities, what is the maximum expected value?

a. $37.10 million

b. $26.71 million

c. $32.55 million

a. $37.10 million

You might also like to view...

The irrational escalation of commitment is a cognitive bias that refers to

A. the perspective or point of view that people use when they gather information and solve problems. B. the standard against which subsequent adjustments are measured during negotiation. C. how easily information can be recalled and used to inform or evaluate a process of a decision. D. a negotiator's commitment to a course of action, even when that commitment constitutes irrational behavior on his/her part.

Roger Corporation produces goods in the United States, to be sold by a separate division located in Italy. More specifically, the Italian division imports units of product X34 from the U.S. and sells them for $950 each. (Imports of similar goods sell for $850.) The Italian division is subject to a 40% tax rate whereas the U.S. tax rate is only 30%. The manufacturing cost of product X34 in the United States is $720. Furthermore, there is a 10% import duty computed on the transfer price that will be paid by the Italian division and is deductible when computing Italian income. Tax laws of the two countries allow transfer prices to be set at U.S. manufacturing cost or the selling prices of comparable imports in Italy.Required: Analyze the profitability of the U.S. division, the Italian

division, and Roger as a whole to determine if the overall corporation would be better off if transfers took place at (1) U.S. manufacturing cost or (2) the selling price of comparable imports. What will be an ideal response?

Ending a reliance on numerical goals would be associated with which of Deming’s 14 Points for Management?

a. Drive out fear b. Eliminate quotas for workers and managers c. Break down barriers between departments d. Take action to accomplish the transformation

Mr. and Mrs. Nelson operate a small business as a sole proprietorship. This year, they have the following tax information. Net profit from sole proprietorship$50,000 Deduction for SE tax$3,533 Dividends$900 Net income from rental property$2,780 Loss from limited partnership$(6,000)Compute Mr. and Mrs. Nelson's AGI.

A. $50,900 B. $50,147 C. $47,367 D. None of the above