Pam certified a statement prepared by Jace, her employee, without checking his work. Jace was never known to be anything but diligent and his integrity had never been questioned. The audit contained gross misstatements. Pam defends a suit against her claiming "due diligence." She will:

A) succeed, since she had no reason to believe her employee would lie.

B) succeed, because a reasonable person would not have inquired further.

C) fail, because due diligence requires reasonable investigation.

D) fail, because she is automatically liable for her employee's act.

C

You might also like to view...

If your financial plan objective is to provide your family with the most insurance benefit in the event of your untimely death, you should purchase

A) decreasing-term insurance. B) term insurance. C) universal life insurance. D) whole life insurance.

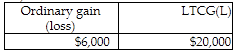

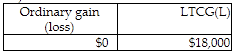

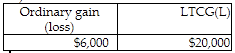

A review of Pranav's reporting of Sec. 1231 transactions for the prior five years indicates a net Sec. 1231 loss of $14,000 three years ago and a net Sec. 1231 gain of $8,000 last year (before the five-year lookback). Pranav will recognize

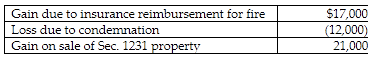

This year Pranav had the gains and losses noted below on property, plant and equipment used in his business. Each asset had been held longer than one year.

A)

B)

C)

D)

Security legislation

a. has not had much impact on transportation carriers. b. has caused some firms to stop offshore sourcing. c. has caused expense issues for carriers. d. has created unnecessary restrictions of legitimate trade.

Which of the following accounting principles require that all goods and services purchased be recorded at actual cost?

A) Going-concern assumption. B) Expense recognition (Matching) principle. C) Measurement (Cost) principle. D) Business entity assumption. E) Consideration assumption.