The imposition of a tax on a good or service would be represented as

A. an increase in demand.

B. an increase in supply.

C. a decrease in demand.

D. a decrease in supply.

D. a decrease in supply.

You might also like to view...

Using the aggregate supply and demand model, assume the economy is operating along the intermediate portion of the aggregate supply curve. An increase in the money supply will increase the price level and:

a. lower both the interest rate and real GDP. b. raise both the interest rate and real GDP. c. lower the interest rate and raise GDP. d. raise the interest rate and lower real GDP.

After the U.S. introduces of a tariff in the market for phones, the price of phones in the U.S. will

a. decrease b. increase c. remain the same d. change in an indeterminate manner

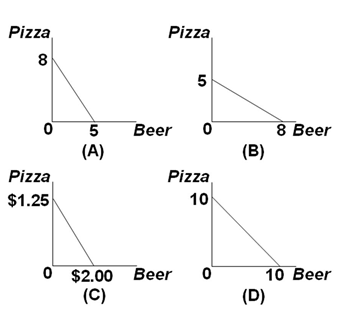

Refer to the graphs below. Pizza and beer are the only two goods Jon consumes. The price of beer is $2.00 per pitcher and pizza is $1.25 per slice. If Jon has only $10 to spend for the evening, which graph represents the set of possible combinations of beer and pizza that he can buy?

A. Graph A

B. Graph B

C. Graph C

D. Graph D

Credit card companies put a low "minimum required payment" on people's bills in the hope that people will send in low payments thereby allowing the card companies to earn more interest. The companies are trying to exploit the:

A. Framing effect B. Anchoring effect C. Confirmation bias D. Endowment effect