Lucy and Desi are experiencing dialectical tensions between themselves that do not involve anyone in their extended family. Which kinds of tensions are Lucy and Desi experiencing?

A. Internal

B. Autonomous

C. External

D. Disconnected

A. Internal

You might also like to view...

Which of the following is not true?

a. A trial balance can be in balance even though an error exists in the general ledger; b. The ruling method is used to correct errors; c. Source documents trigger an analysis of the financial statements; d. Accounts are listed in the trial balance in the order listed in the chart of accounts; e. A difference in the trial balance column totals that is evenly divisible by 9 indicates a transposition error.

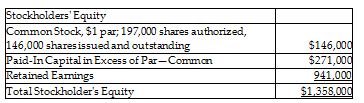

On June 30, 2018, Chris Brothers, Inc. showed the following data on the equity section of their balance sheet:

On July 1, 2018, the company declared and distributed a 8% stock dividend. The market value of the stock at that time was $17 per share. Following this transaction, what is the balance of Paid-In Capital in Excess of Par—Common?

A) $227,640

B) $523,160

C) $271,000

D) $457,880

The ________ doctrine holds that courts should apply the law of the state that has the most interest in determining the outcome of the dispute

A. act of state B. vested rights C. most significant relationship D. governmental interest

On November 1, 2017, McEwing, Inc declared a dividend of $5

00 per share. McEwing, Inc has 20,000 shares of common stock outstanding and no preferred stock. The date of record is November 15, and the payment date is November 30, 2017. Which of the following is the journal entry needed on November 30, 2017? A) Debit Cash Dividends $100,000, and credit Dividends Payable-Common $100,000. B) Debit Dividends Payable-Common $100,000, and credit Cash $100,000. C) Debit Cash $100,000, and credit Dividends Payable-Common $100,000. D) Debit Cash Dividends $100,000, and credit Cash $100,000.