The national debt is unlikely to cause national bankruptcy because the federal government can:

a. raise taxes.

b. print money.

c. refinance its debt.

d. all of these.

d

You might also like to view...

Consider a negative income tax. As discussed in your textbook, under the negative income tax, each person is entitled to a grant of G dollars per month. For every dollar the person earns, the grant is reduced by t dollars. Suppose G = 200 and t = 0.40. Consider an individual whose hourly wage is $10. There are 30 days in a month (so T is 720). Sketch the budget constraint before and after the introduction of a negative income tax.

What will be an ideal response?

Supporters of supply side economics believe that

a. government should be used as a tool to increase demand for goods b. demand for goods increases when prices rise c. taxes have a strong negative influence on economic output d. tax cuts have little impact on worker productivity

Vineland and Moonited Republic produce wine and cheese. The opportunity cost for the production of a bottle of wine in Vineland is two pounds of cheese, and in the Moonited Republic is 2.5 pounds of cheese. Based on this information, it can be concluded that

A. Vineland has an absolute disadvantage in the production of both goods. B. Vineland has a comparative advantage in the production of wine. C. based on comparative advantage trade between the two countries is not possible. D. Vineland has a comparative advantage in the production of cheese and Moonited has a comparative advantage in the production of wine.

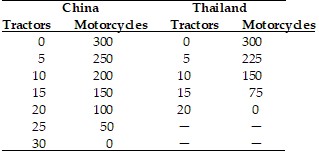

Refer to the information provided in Table 33.2 below to answer the question(s) that follow.

Table 33.2 Refer to Table 33.2. If both countries specialize and trade with each other, Thailand will export ________ and China will import ________.

Refer to Table 33.2. If both countries specialize and trade with each other, Thailand will export ________ and China will import ________.

A. tractors; tractors B. motorcycles; tractors C. motorcycles; motorcycles D. tractors; motorcycles