Paris Corporation has E&P of $200,000. Paris owns all of Slider Corporation's stock, which is worth $80,000. The stock has been held for five years. Paris distributes all of the Slider stock and $20,000 cash to a 50% shareholder in exchange for all of the shareholder's 100 shares of Paris stock. The exchange qualifies as a Sec. 355 split-off transaction. The 50% shareholder's basis in the Paris

stock surrendered is $90,000. What is the amount of the gain that the 50% shareholder must recognize?

What will be an ideal response?

FMV of Slider stock received $ 80,000

Plus: cash received 20,000

Amount realized $100,000

Minus: basis of Paris stock ( 90,000)

Realized gain $ 10,000

Recognized gain $ 10,000

The recognized gain is taxed as a capital gain under the Sec. 302(b) rules. The shareholder receives $20,000 cash in exchange for part of his/her Paris stock, which is followed by an exchange of the remaining Paris stock for the Slider stock. The redemption reduces the shareholder's interest from 50% (100/200 = 50%) to 44% (80/180 = 44.44%) which should be "not essentially equivalent to a dividend" under Sec. 302(b)(1). See Rev. Rul. 93-62.

You might also like to view...

Operating, investing, and financing activities affect certain balance sheet accounts. Which of the following statements is true?

a. Operating activities primarily involve transactions which affect noncurrent assets. b. Investing activities primarily involve U.S. government securities and long-term productive assets. c. Financing activities primarily involve transactions which affect current liabilities. d. Different balance sheet accounts are affected depending on whether the direct or indirect method is used.

A retailer that sells designer clothes and accessories has a pop-up ad on Facebook that features their new collection. Which method for satisfying customers' hedonic needs has been used?

A. Consideration set B. Status and power C. Stimulation D. Conversion rate E. Adventure

The advertising slogan, "We bring good things to life," used by General Electric to market itself, is an example of ________ marketing

A) person B) corporate image C) internal D) place E) niche

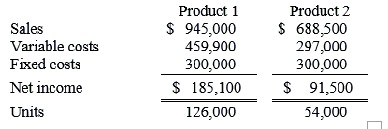

Next year's budget for Temper, Inc., is given below:  At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales 1 126,200 $958,579 2 56,800 $721,010 Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the sales mix variance for each product.c. Compute the sales quantity variance for each product.

At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales 1 126,200 $958,579 2 56,800 $721,010 Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the sales mix variance for each product.c. Compute the sales quantity variance for each product.

What will be an ideal response?