When evaluating the cash flows associated with a capital budgeting project, shipping and installation costs associated with the purchase of an asset, such as a lathe, are considered part of the:?

A. ?initial investment outlay because these expenses are effectively part of the asset's purchase price.

B. ?incremental operating cash flows because shipping and installation costs represent expenses that have to be written off over the life of the asset.

C. ?terminal cash flows, because these expenses aren't paid until the end of the asset's life.

D. ?sunk costs because these expenses do not affect any current or future cash flows associated with investing in the asset.

E. ?opportunity cost of the project because these costs are increasing the potential of the project.

Answer: A

You might also like to view...

The use of quantitative tools to gauge an organization's performance in relation to a specific goal or an expected outcome is known as

A) responsibility accounting. B) an asset turnover. C) a performance center. D) a performance measurement.

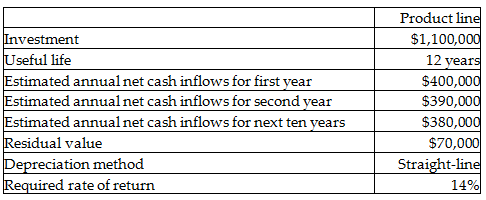

Calculate the payback period for the investment. (Round your answer to two decimal places.)

The following details are provided by a manufacturing company:

A) 2.75 years

B) 2.82 years

C) 2.55 years

D) 2.77 years

It has been estimated that what percentage of expatriates leaves their firm within 3 years of their return?

A. 10% B. 34% C. 14% D. 24%

Which approach to marketing was especially important during the Great Depression when consumers did not have much money and firms competed intensely for customer sales?

A. marketing concept B. sales orientation C. production orientation D. customer orientation E. relationship marketing