Which of the following is false about a liquidity trap situation:

a. The Fed could not appreciably raise short term interest rates

b. If the Fed added reserves to the banking system, it would have little effect on investment.

c. Traditional monetary policy would be relatively weak in its effects on aggregate demand.

d. Expansionary monetary policy would tend to increase excess reserves in the banking system.

a

You might also like to view...

If marginal revenue is greater than zero, then demand at this level of output is

A) unit elastic. B) elastic. C) inelastic. D) steeper than the marginal revenue curve.

What are the main influences on the elasticity of supply that make the supply of some goods elastic and the supply of other goods inelastic?

What will be an ideal response?

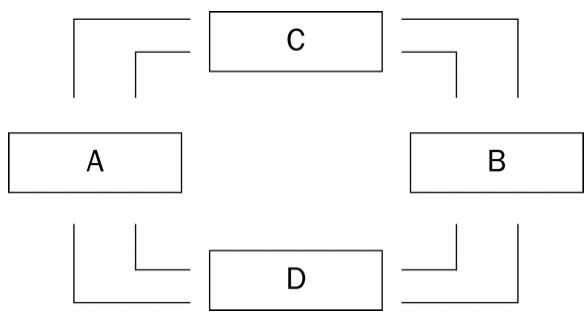

Refer to Figure 1. The figure represents a circular-flow diagram. Boxes C and D represent

a. households and government.

b. firms and government.

c. the markets for goods and services and the financial markets.

d. None of the above are correct.

Consider the price paid for debt issued by the State of California. Which of the following would lead to a decrease in the value of State of California bonds?

A. The State of California pays back its previous bonds ahead of schedule. B. The State of California bonds have a shorter maturity. C. The State of California bonds are in small dollar amounts. D. The State of California experiences a fiscal crisis that makes it less likely it will be able to honor its interest payments.