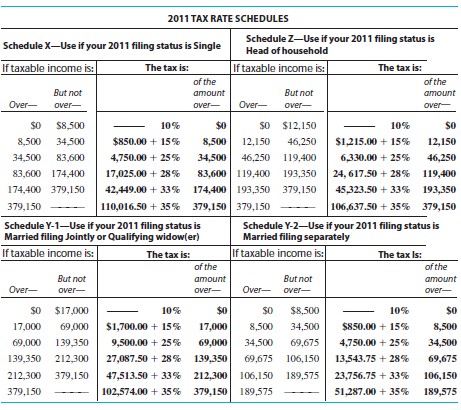

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Mark Collins had an adjusted gross income of $24,014 last year. He had deductions of $976 for state income tax, $563 for property tax, $2827 in mortgage interest, and $230 in contributions. Collins claims one exemption and files as a single person.

Mark Collins had an adjusted gross income of $24,014 last year. He had deductions of $976 for state income tax, $563 for property tax, $2827 in mortgage interest, and $230 in contributions. Collins claims one exemption and files as a single person.

A. $1752.10

B. $1062.70

C. $3027.10

D. $1932.70

Answer: A

You might also like to view...

Find the relative extrema of the function and classify each as a maximum or minimum.f(x) = 2x2 + 12x + 20

A. Relative minimum: (-2, 3) B. Relative maximum: (3, -2) C. Relative minimum: (-3, 2) D. Relative minimum: (2, -3)

Find the exact values of s in the given interval that satisfy the given condition.[0, 2?); sin s =

A.  ,

,

B.  ,

,

C.

D.

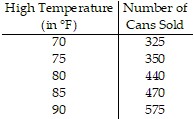

Solve.The table gives the number of cans of soda sold at a campus stand on five days with different high temperatures for the day. Write this data as a set of ordered pairs of the form  Then create a scatter diagram of the data.

Then create a scatter diagram of the data.

What will be an ideal response?

Combine like terms whenever possible.6y - 6x4y + 9y - 9x4y

A. 30y - 30x4y B. 15y - 15x4y C. 15y + 3x4y D. -3y - 15x4y