If a company using the adjusted sales value method to assign joint costs produces two products, A and B, from a joint process, and B requires additional processing after the split-off in order to be salable, how is the joint cost allocated to B determined?

a. The costs of the additional processing are ignored in allocating joint costs.

b. The costs of the additional processing are subtracted from the joint costs allocated to B.

c. The relative sales value used to allocate the joint cost are determined after the costs of further processing are subtracted from the ultimate sales value of B.

d. None of these are correct.

c

You might also like to view...

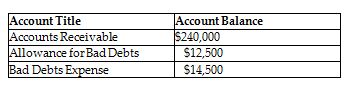

After the December 31, 2019 adjusting journal entries have been posted, Tri-State Distributors has the following account balances (all accounts have normal balances) are:

Use this information to prepare, in good form, the Balance Sheet (partial) on December, 31, 2019. Include a proper heading.

A company regularly conducts classes in moral philosophy for its employees. In addition, it ensures that whistleblowers are protected from ostracism or mistreatment. These measures have been specifically taken to

A. develop a compliant workforce in the organization. B. create an ethical climate in the organization. C. establish an ethnocentric work environment in the organization. D. increase punitive actions against wrongdoers in the organization. E. stay away from ethical dilemmas in the organization.

Firms focusing on cost leadership tend to

A) locate facilities close to the market they serve. B) locate facilities very far from the market they serve. C) find the lowest cost location for their manufacturing facilities. D) select a high-cost location to be able to react quickly.

Nissan and Renault were able to reduce their purchasing spend by which technique?

a. Standardization b. Cross-functional teams c. Optimization d. Simulation