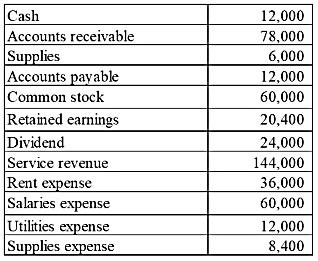

The following is a list of all of the account balances for the Jepson Corporation immediately prior to closing the books on December 31, Year 1: Required:Prepare an adjusted trial balance dated December 31, Year 1.

Required:Prepare an adjusted trial balance dated December 31, Year 1.

What will be an ideal response?

| Jepson Corporation |

| Adjusted Trial Balance |

| December 31, Year 1 |

| ? | Debit | Credit |

| Cash | 12,000 | ? |

| Accounts receivable | 78,000 | ? |

| Supplies | 6,000 | ? |

| Accounts payable | ? | 12,000 |

| Common stock | ? | 60,000 |

| Retained earnings | ? | 20,400 |

| Dividends | 24,000 | ? |

| Service revenue | ? | 144,000 |

| Rent expense | 36,000 | ? |

| Salaries expense | 60,000 | ? |

| Utilities expense | 12,000 | ? |

| Supplies expense | 8,400 | |

| Totals | 236,400 | 236,400 |

You might also like to view...

Pension-related estimates (not funding data) are provided by the

a. employer company. b. independent actuary. c. pension fund trustees. d. employee union.

A provision in the California state constitution conflicts with a provision in the U.S. Constitution. If challenged

a. neither provision will be enforced. b. the provisions will be balanced to reach a compromise. c. the state provision, not the U.S. Constitution, will be enforced. d. the U.S. Constitution, not the state provision, will be enforced.

Which of the following statements is true?

A. Singles and young couples are less willing to try new products than are older couples. B. Buying responsibility and influence vary little from one family to another. C. Empty nesters are frequently big spenders. D. Divorced families usually have more discretionary income than traditional families. E. None of these statements is true.

It is not possible for a corporation to be guilty of a criminal felony violation of the Sherman Act

Indicate whether the statement is true or false