In 2008, Yolanda paid $3,875 in Social Security tax. If the Social Security tax rate was 6.2% to the maximum income of $94,200 that year, what was Yolanda's taxable income?

A. $6,250

B. $38,750

C. $62,500

D. $66,375

Answer: C

Mathematics

You might also like to view...

Find the unit tangent vector T(t).

r(t) = (2 sint, 4t, 2 cost)

Mathematics

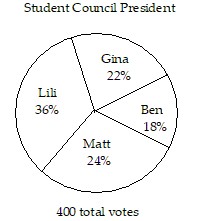

The circle graph shows the results of the student council presidential election. The complete circular area represents 100% of the votes. The circle graph shows what percent of the vote each person received.Who got the fewest votes?

The circle graph shows what percent of the vote each person received.Who got the fewest votes?

A. Lili B. Matt C. Ben D. Gina

Mathematics

Answer the following statement(s) true (T) or false (F)

The parabola y = x^2 has vertical asymptotes.

Mathematics

Compute the partial sum of the geometric series for the stated value of n. Round your answers to four decimal places.ak = 3 (k-1); n= 11

(k-1); n= 11

A. S11 = 4.4999746 B. S11 = 7.4345746 C. S11 = 2.4653746 D. S11 = 4.4653746

Mathematics