?

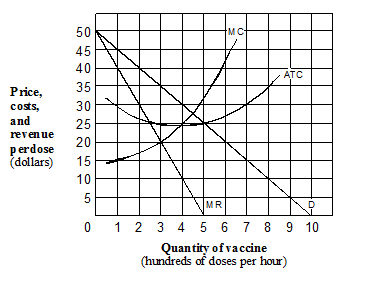

Exhibit 8-3 Demand and cost curves for GeneTech, a monopolist with a patented vaccine

Consider Exhibit 8-3. Suppose GeneTech's patent expires and the market for the vaccine becomes perfectly competitive. Which of the following price and quantity combinations would be most likely?

A. $45 per dose and 100 doses per hour

B. $40 per dose and 200 doses per hour

C. $35 per dose and 300 doses per hour

D. $28 per dose and 450 doses per hour

Answer: D

You might also like to view...

The three main categories of government outlays are

A) net interest payments, government investment, and government consumption expenditures. B) net government subsidies, the government deficit, and government purchases. C) government purchases, transfer payments, and net interest payments. D) government consumption expenditures, government investment, and transfer payments.

How does hedging affect the flow of funds in the financial system?

A) It reduces it since it is a sign that investors do not like risk. B) It reduces it because it increases risk by encouraging speculation. C) It increases it because it reduces risk thus encouraging more people to make financial investments. D) It increases it by encouraging more speculation.

If the interest rate is 7.5 percent, then what is the present value of $4,000 to be received in 6 years?

a. $2,420.68 b. $2,591.85 c. $2,996.33 d. $3,040.63

Suppose the current one-year interest rate is 4%. Also assume that financial markets expect the one-year interest rate next year to be 5%, and expect the one-year rate to be 6% the year after that. Given this information, the yield to maturity on a three-year bond will be approximately

A) 4%. B) 5%. C) 6%. D) 15%.