How does hedging affect the flow of funds in the financial system?

A) It reduces it since it is a sign that investors do not like risk.

B) It reduces it because it increases risk by encouraging speculation.

C) It increases it because it reduces risk thus encouraging more people to make financial investments.

D) It increases it by encouraging more speculation.

C

You might also like to view...

The government wants to reduce white-collar crime. a. Suppose for the moment innocent people are never wrongly convicted of a crime

Explain why the Becker model of crime and punishment suggests that we increase the fines people pay if they are convicted instead of hiring more people to investigate white-collar crime. b. Now suppose that mistakes happen and innocent people are sometimes convicted of white-collar crime. Why in this case might we want to hire more investigators instead of raising fines? What role does equity or fairness play in this case?

GDP is an imperfect measure of well-being because

a. it does not measure standards of living. b. it does not include household production. c. it ignores many of the costs of production. d. it excludes many goods produced within markets. e. both b and c.

The government wishes to close an inflationary gap by reducing real GDP by $400 billion. Assuming a tax multiplier of 4 and an income multiplier of 5, which of the following policy prescriptions would reduce the inflationary gap by $400 billion?

a. Decreasing government spending by $400 billion and increasing taxes by $400 billion. b. Decreasing government spending by $160 billion and decreasing taxes by $100 billion. c. Decreasing government spending by $40 billion and decreasing taxes by $40 billion. d. Decreasing government spending by $80 billion and keeping taxes the same. e. Doing absolutely nothing to the economy.

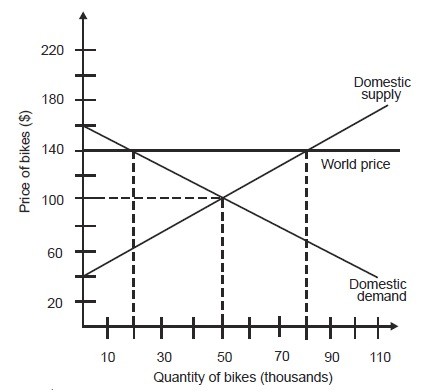

In an open economy, the quantity demanded of bikes in the domestic market is ________.

A. 100,000 B. 20,000 C. 50,000 D. 80,000