Which of the following is true regarding financial reporting for internal service funds?

A. Internal service funds are generally reported in the Business-type Activities column of the government-wide financial statements.

B. Internal service funds are generally reported in the Governmental Activities column of the government-wide financial statements.

C. Internal service funds are aggregated and reported as a major fund in the proprietary fund financial statements.

D. Internal service funds are reported in the governmental fund financial statements.

Answer: B

You might also like to view...

How much was total digital ad spending in 2013?

A) $40.1 million B) $42.8 million C) $18.4 billion D) $40.1 billion E) $42.8 billion

List and briefly explain the four zones in which people interact in our culture

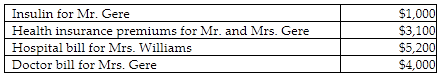

Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000 in 2018. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.

A) $5,200

B) $8,300

C) $9,550

D) $13,300

________ is the prejudgment of a person or situation based on attitudes.

A. Intolerance B. Repugnance C. Antipathy D. Prejudice