A taxpayer can exclude from gross income any interest earned on bonds issued by any state, any possession of the United States, any political subdivision of either of the foregoing, or of the District of Columbia as long as these bonds are not issued for private activities.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

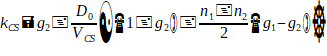

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

As a general rule, revenues should not be recognized in the accounting records when earned, but rather when cash is received.

Answer the following statement true (T) or false (F)

Use of visual aids will not help you achieve

A) Subjective writing B) Cosmetic appeal. C) Clarity. D) Conciseness.

If mutually agreeable, management and labor can bargain over plant closings, interest arbitration, benefits for retirees, and bargaining unit expansion. These are all examples of _______________________________.

Fill in the blank(s) with the appropriate word(s).