The rationale for ability-to-pay taxation and the contention that those with large incomes should pay more taxes both absolutely and relatively is that:

A. high-income receivers are generally in a better position to shift taxes than are low-income

receivers.

B. the transfer system is regressive and it is therefore essential to have an offsetting

progressive tax structure.

C. rational consumers spend their first dollars of income on the most urgently desired goods

and successive dollars on less essential goods.

D. taxes should be paid for financing public goods in direct proportion to the satisfaction an

individual derives from those goods.

Answer: C

You might also like to view...

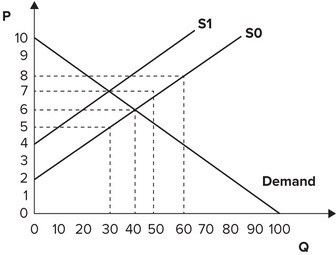

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, consumer surplus will fall from:

A. 80 to 45. B. 160 to 80. C. 90 to 45. D. 160 to 90.

If the domestic producers of a good benefit from free trade, it suggests that the country:

A. does not have an absolute advantage in that good. B. is a net importer of that good. C. does not have a comparative advantage in that good. D. is a net exporter of that good.

The practice of securitization of mortgages:

A. pooled the risk of mortgages, allowing higher risk mortgages to be more safely sold to investors. B. allowed investors to profit from the mortgage payments without being exposed to any risk. C. was undertaken by government to guarantee the values of real estate. D. pooled high-risk mortgages together, which raised the prices of them to investors.

Recall the Application about low-price guarantees and the prices of tires to answer the following question(s).Recall the Application. From a pricing standpoint, low-price guarantees seem to benefit:

A. the buyer. B. the seller. C. both the buyer and the seller. D. neither the buyer nor the seller.