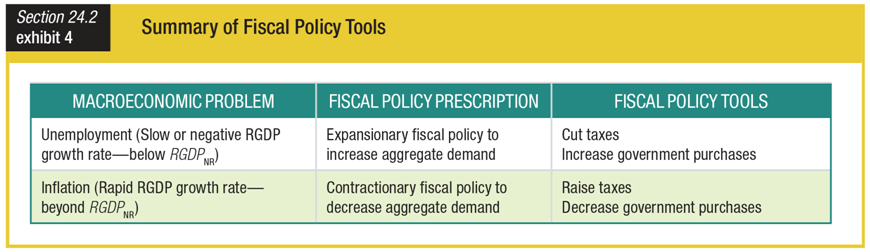

Based on the table showing a summary of fiscal tools, if the government increases taxes, it is most likely trying to ______.

a. fight inflation

b. utilize expansionary policy

c. boost aggregate demand

d. fight unemployment

a. fight inflation

You might also like to view...

If a foreign company operating in a country changes work rules resulting in a more flexible allocation of resources in the various sectors of the domestic economy,________

A) the productivity of domestic workers is likely to decrease B) the productivity of domestic workers is likely to increase C) the gross domestic product of the economy is likely to decrease D) the Human Development Index of the country is likely to decrease

If a perfectly competitive firm finds that the price exceeds its ATC, then the firm

A) will raise its price to increase its economic profit. B) will lower its price to increase its economic profit. C) is making an economic profit. D) is incurring an economic loss. E) is making zero economic profit.

Why is the demand curve the same as the marginal benefit curve?

What will be an ideal response?

When the short term adjustment of a nation's price level is sluggish, economists will often discuss the nation's

A) price inertia. B) policy assignment. C) trade restrictions. D) central bank independence.