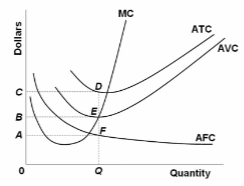

Refer to the diagram. At output level Q total fixed cost is:

A. 0BEQ.

B. BCDE.

C. 0BEQ - 0AFQ.

D. 0CDQ.

B. BCDE.

You might also like to view...

The above table has the demand and supply schedules for money. What is the equilibrium nominal interest rate?

A) 8 percent B) 7 percent C) 6 percent D) 5 percent E) 9 percent

"An increase in the real interest rate increases the quantity of investment." Is the previous statement correct or incorrect?

What will be an ideal response?

If the Fed purchases $1 million worth of securities and the required reserve ratio is 8%, by how much will deposits increase (assuming no change in excess reserves or the public's currency holdings)?

A) rise by $1 million B) decline by $1 million C) rise by $8 million D) rise by $12.5 million

Explain how globalization impacts inflation in both the short run and the long run.

What will be an ideal response?