Which of the following correctly describes the Phillips curve? ?

A. ?A curve showing the inverse relationship between interest rates and the quantity of money demanded.

B. ?A curve showing the direct relationship between interest rates and the quantity of money demanded.

C. ?A curve showing the direct relationship between the inflation rate and the unemployment rate.

D. ?A curve showing the inverse relationship between the inflation rate and the unemployment rate.

Answer: D

You might also like to view...

At a firm's break-even point, its

A) total revenue equals its total opportunity cost. B) marginal revenue exceeds its marginal cost. C) marginal revenue equals its average variable cost. D) marginal revenue equals its average fixed cost.

A market basket:

A. looks like a really long shopping list for what firm’s typically purchase. B. includes specific goods and services in fixed quantities that roughly correspond to a typical consumer's spending. C. onlyincludes housing, food, and clothing, but not things like transportation. D. is what an economist creates in order to understand purchasing trends of households and firms.

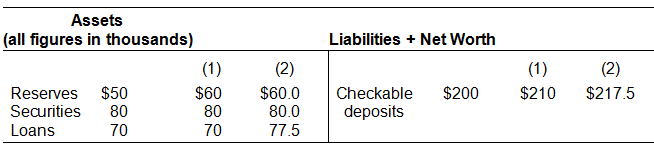

If the balance sheet below were for the entire banking system instead of just a single bank, by how much could loans be expanded? Assume a reserve ratio of 33%.

Refer to the information provided in Figure 12.4 below to answer the question(s) that follow. Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Currently in sector Y, price is

Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Currently in sector Y, price is

A. equal to average cost. B. less than average cost. C. greater than average cost. D. More information is needed to answer the question.