If there were no fractional reserve banking, then:

A. the reserve ratio must be 0percent.

B. banks would not create money in the economy.

C. there would be a very small amount of lending using deposits.

D. banks would not be able to create as much money as they desired.

B. banks would not create money in the economy.

You might also like to view...

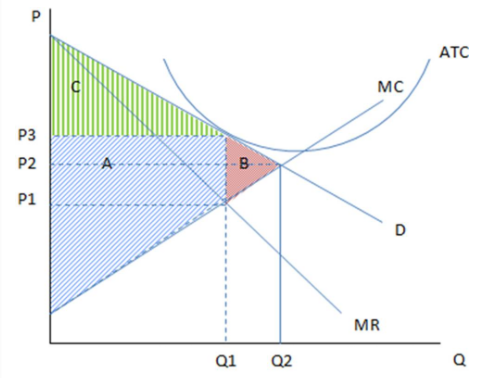

If the firm in the given graph were to produce Q1 and charge P3, the area C would represent:

These are the cost and revenue curves associated with a firm.

A. producer surplus.

B. consumer surplus.

C. deadweight loss.

D. profits.

According to many economists, production that occurs in the underground economy

a. has no market value and therefore should not be included in GDP b. is given too much weight by the Bureau of Economic Analysis, causing GDP to overstate true output c. consists exclusively of illegal production activities such as drug selling and prostitution d. is accurately accounted for by the Bureau of Economic Analysis in its measurement of GDP e. is given insufficient weight by the Bureau of Economic Analysis, causing GDP statistics to understate true output

Which of the following would not be counted in the U.S. balance of payments' current account?

a. Helen, an American oil engineer, is a paid adviser to Mexico. b. Exxon owns oil fields in Mexico. c. France purchases a new jet fighter aircraft from the Boeing Company in Seattle. d. Martha receives a $50 dividend check on stock she owns in a business in Mexico. e. A wealthy Italian purchases numerous antiques in the United States for his Roman villa.

The money supply decreases if

a. households decide to hold relatively more currency and relatively fewer deposits and banks decide to hold relatively more excess reserves and make fewer loans. b. households decide to hold relatively more currency and relatively fewer deposits and banks decide to hold relatively fewer excess reserves and make more loans. c. households decide to hold relatively less currency and relatively more deposits and banks decide to hold relatively more excess reserves and make fewer loans. d. households decide to hold relatively less currency and relatively more deposits and banks decide to hold relatively less excess reserves and make more loans.