What is the probability that the project will take longer than 58 days to complete?

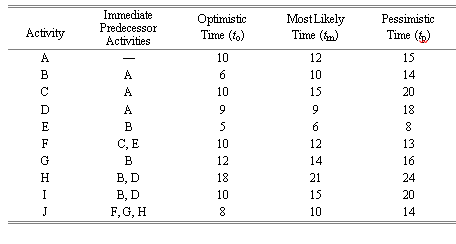

Marcy Fetter, a staff analyst at the Los Angeles plant of Computer Products Corporation, is assigned to the team that is developing the process design for producing an RFID sensor. The corporate planning group in San Jose, California, has contacted her and asked how confident the design group is about completing the project in 60 days. She has developed the following estimated time durations in days for the project:

For path A-D-H-J:

SVt = 0.694 + 0.694 + 1.000 + 1.000 = 3.388 days

z = (x – m)/st = (58 – 54)/1.84 = 2.17

P(D > 58) = 1 – 0.9850 = 0.0150 or about 1.5%

(There is a 98.5% chance of the project being completed within 58 days.)

You might also like to view...

Bonds Sinking Fund is reported as a liability on the corporation's balance sheet

a. True b. False Indicate whether the statement is true or false

Reaction to the communication as transmitted to the sender is known as:

A. feedback. B. message. C. medium. D. decoder. E. source.

Which one of the following statements about sales and operations planning is BEST?

A) A production plan generally focuses on production rates and inventory holdings, whereas a staffing plan focuses on staffing and other labor-related factors. B) Supply options are actions that adjust demand patterns. C) Operations and marketing are the only two functional areas that supply inputs for developing production and staffing plans. D) A level strategy stabilizes inventory levels by adjusting production rates or staff levels to match demand levels over the planning horizon.

An employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% of the first $127,200 of employee earnings per calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employer must pay?

A. $420.00 B. $0.00 C. $375.00 D. $42.00 E. $378.00