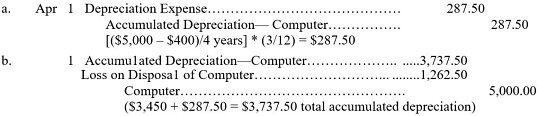

On April 1, 2015, due to obsolescence resulting from a new technology, a company discarded a computer that cost $5,000, had a useful life of 4 years, and a salvage value of $400. Based on straight-line depreciation, the accumulated depreciation as of December 31, 2014 was $3,450. a. Prepare the journal entry to record depreciation up to the date of disposal of the computer.b. Prepare the journal entry to record the disposal of the computer.

What will be an ideal response?

You might also like to view...

Which of the following is an example of a geographic variable?

A) lifestyle B) race C) religion D) climate

Crystal Glassware Company issues $1,042,000 of its 14%, 10-year bonds at 97 on February 28, 2019. The bonds pay interest on February 28 and August 31. Assume that Crystal uses the straight-line method for amortization. What net amount will be reported for the bonds on the August 31, 2019 balance sheet?

A) $1,012,303 B) $1,042,000 C) $1,009,177 D) $1,010,740

Property tax expense for a department store's store equipment is an example of a direct expense

Indicate whether the statement is true or false

When employees receive a salary increase by means of the percentage- of-salary increase method, the salary differential between the lower- and higher-paid individuals soon diminishes

Indicate whether the statement is true or false.