Which of the following statements is not consistent with the quantity theory of money?

A. The velocity of money can be affected by how frequently workers are paid.

B. Velocity can change with changes in the interest rate.

C. The velocity of money can be affected by the development of new financial instruments, such as interest-bearing checking accounts.

D. The velocity of money can be affected by the manner in which the banking system clears transactions between banks.

Answer: B

You might also like to view...

Traditionally, economists have considered culture, customs, and religion as

A) very important influences on the choices consumers make. B) subject to normative economic analysis rather than positive economic analysis. C) relatively unimportant factors in explaining the choices consumers make. D) important influences in explaining consumer choices in command economies but less important in market economies.

The U.S. unemployment insurance program

A) decreases the level of frictional unemployment. B) pays the unemployed a benefit equal to twice the average wage. C) increases the amount of time the unemployed spend searching for a job. D) eliminates structural unemployment.

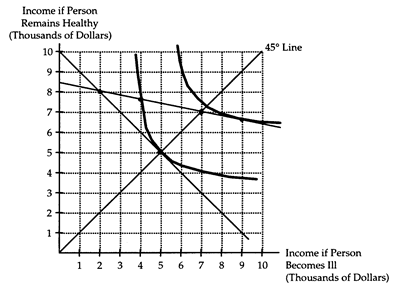

Great Benefit is a health insurance company with two types of customers: healthy persons and sickly persons. A healthy person has 1-to-5 odds of getting ill, and a sickly person has 1-to-1 odds of getting ill. However, the insurance company cannot distinguish between healthy and sickly persons. Brett is a risk-averse person who purchases health insurance from Great Benefit. Without insurance, Brett's income will be $8,000 if he remains healthy and $2,000 if he becomes ill. Brett's situation is diagrammed below.

(i) Is Brett a healthy person or a sickly person? How can you tell?

(ii) Suppose Great Benefit offers two policies-one at fair odds for healthy persons and one at fair odds for sickly persons-that can be purchased in unlimited quantities. What type of policy and how much insurance will Brett choose to purchase?

(iii) What type of information problem does the insurance company face? What limit should the insurance company place on insurance at "healthy" odds to deal with this problem?

The measured capital stock in developed countries

a) overestimates real capital growth because capital prices have risen dramatically in recent years b) underestimates real capital growth because machines have become more powerful and less expensive c) overestimates real capital growth because the manpower needed to operate new machines in greater than in previous years d) underestimates real capital growth because it does not include financial investments e) overestimates real capital growth because it includes government consumption expenditures