Suppose a supplier has an agreement with a firm to be paid $50,000 in 4 years. If the annual interest rate is 1 percent, the supplier would be indifferent between receiving ________ now and waiting 4 years to receive the $50,000.

A) 49,557.89

B) $48,049.02

C) $49,550.22

D) $48,076.92

B) $48,049.02

You might also like to view...

From 2007 to 2009 our current account deficit

A. has been cut in half. B. stayed about the same. C. almost doubled. D. more than tripled.

Refer to Figure 12-5. The firm's manager suggests that the firm's goal should be to maximize average profit. In that case, what is the output level and what is the average profit that will achieve the manager's goal?

A) Q = 1,800 units, average profit = $20 B) Q = 1,350 units, average profit = $5 C) Q = 1,100 units, average profit = $6 D) Q = 1,350 units, average profit = $9

According to mainstream economists, a restrictive monetary policy might be frustrated, wholly or in part, by:

A. Treasury sales of gold bullion. B. a Treasury surplus. C. the desire of households and businesses to hold smaller money balances. D. a decrease in V.

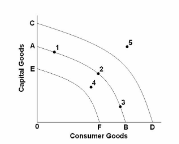

Assume a nation's current production possibilities are represented by the curve AB in the above diagram. Economic growth would best be indicated by a:

A. Shift in the curve from AB to CD

B. Shift in the curve from AB to EF

C. Movement from point 1 to point 2

D. Movement from point 3 to point 4