Which of the following is NOT an example of price discrimination?

A) student discount at a local movie theater

B) breakfast cereal makers sending coupons to select buyers

C) Pharmaceutical companies charge customers living in wealthier countries higher prices than for identical drugs in poorer nations.

D) a hard cover book selling for more than the same book in electronic form

Answer: D

You might also like to view...

Answer the following statements true (T) or false (F)

1. All people in the non institutional population are counted as members of the labor force. 2. The labor force participation rate describes the civilian labor force as a percentage of the civilian noninstitutional population. 3. The total U.S. labor force excludes members of the armed services stationed outside the United States. 4. All college students are excluded from the U.S. labor force. 5. The increase in U.S. population during the past few years has required an increase in the number of agriculture workers to meet food requirements.

In the prisoner's dilemma setting for producing and stealing, a tax imposed on participants could end up changing the payoff matrix so that

A) one participant is better off, and one participant is worse off. B) both participants are worse off. C) both participants are better off. D) all of the above are possible

An increase in the expected future price of a good will cause the current demand for the good to

a. decrease, which is a shift to the left of the demand curve. b. decrease, which is a shift to the right of the demand curve. c. increase, which is a shift to the left of the demand curve. d. increase, which is a shift to the right of the demand curve.

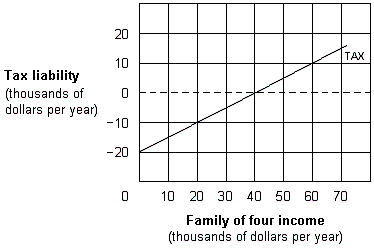

Exhibit 12-7 Negative income tax

A. receive the maximum negative income tax payment of $20,000. B. receive payments under the negative income tax. C. pay no income taxes, but receive no payments. D. pay taxes of $5,000.