Douglas bought office furniture two years and four months ago for $25,000 to use in his business and elected to expense all of it under Sec. 179. Depreciation of $3,500 would have been taken under the MACRS rules. If Douglas converts the furniture to nonbusiness use today, Douglas must

A) amend the prior two years tax returns.

B) include $3,500 in gross income in year of conversion.

C) include $21,500 in gross income in year of conversion.

D) include $25,000 in gross income in year of conversion.

C) include $21,500 in gross income in year of conversion.

$25,000 depreciation taken - $3,500 depreciation that would have been taken = $21,500 must be recaptured.

You might also like to view...

The ratios that are used to determine a company's short-term debt paying ability are:

A) asset turnover, times interest earned, current ratio, and account receivable turnover. B) times interest earned, inventory turnover, current ratio, and accounts receivable turnover. C) times interest earned, quick ratio, current ratio, and inventory turnover. D) current ratio, quick ratio, account receivable turnover, and inventory turnover.

________ often separates the winners from the losers in business.

A. Technology B. People C. Service D. Speed E. Quality

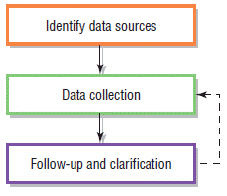

Referring to the accompanying figure, there are a number of data collection tools and techniques. Telephone calls, simulations of actual events and activities, and random samples of data are examples of ____.

Referring to the accompanying figure, there are a number of data collection tools and techniques. Telephone calls, simulations of actual events and activities, and random samples of data are examples of ____.

A. other data collection methods B. the questionnaire method C. the output method D. the direct observation method

Chelsea is a marketing manager and receives a lump sum payment from her company based on the company's higher-than-normal profits from last year. This compensation is called a ________

A) salary B) wage C) commission D) bonus E) defined contribution plan