Answer the following statements true (T) or false (F)

1. A change in business taxes and regulation can affect production costs and aggregate supply.

2. If productivity increases, then the per-unit production cost decreases.

3. Macroeconomic equilibrium in the short run always occurs at full-employment GDP.

4. If the cost of resources decreases, then real domestic output will increase.

1. TRUE

2. TRUE

3. FALSE

4. TRUE

You might also like to view...

The proponents of rational expectations believe that

a. there will be a substantial time lag before people anticipate the eventual effects of a shift to a more expansionary macro-policy. b. macro-policies that stimulate demand and place upward pressure on the general level of prices will temporarily increase output and employment. c. the inflationary side effects of expansionary policies will be anticipated quickly, and therefore, even their short-run effects on real output and employment will be minimal. d. discretionary changes in macro-policy can be made in a manner that will reduce the economic ups and downs of a market economy.

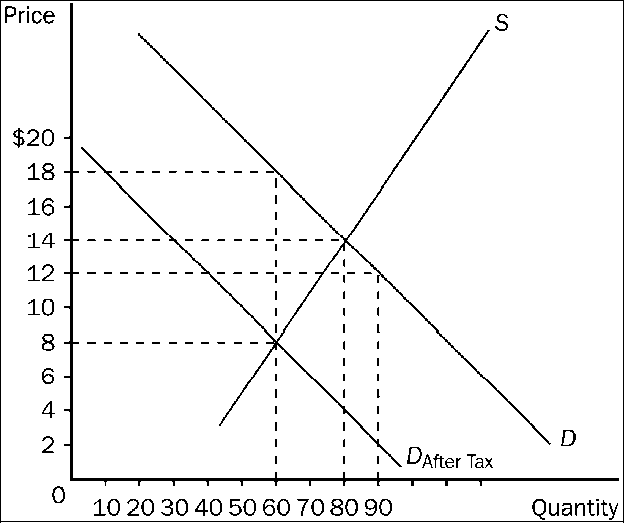

Figure 4-21

Refer to . The per-unit burden of the tax is

a.

$4 on buyers and $4 on sellers.

b.

$5 on buyers and $5 on sellers.

c.

$4 on buyers and $6 on sellers.

d.

$6 on buyers and $4 on sellers.

Which of the following was established first?

a. gatt b. nafta c. wto d. a and b were established at the same time

Suppose that the inverse demand for a downstream firm is P = -82 ? 2Q. Its upstream division produces a critical input with costs of CU(Qd) = 3(Qd)2. The downstream firm's cost is Cd(Q) = 2Q. When there is no external market for the downstream firm's critical input, the downstream firm should produce:

A. 14 units. B. 10 units. C. 12 units. D. 8 units.