Suppose that interest income is exempted from taxation, which costs the Treasury $100 billion in tax revenues, while at the same time transfer payments are reduced by $100 billion

Together, these two changes in fiscal policy ________ national saving while moving the distribution of income toward greater ________ . A) reduce, equality

B) reduce, inequality

C) increase, equality

D) increase, inequality

E) do not affect, equality

D

You might also like to view...

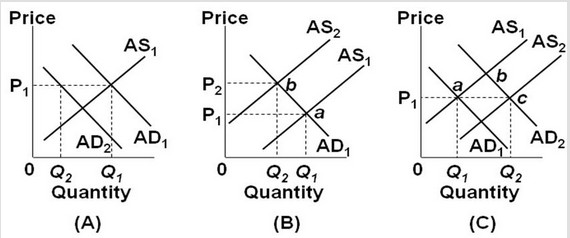

Use the following graphs to answer the next question. In the diagrams, AD1 and AS1 are the "before" curves. Assuming Q1 is full-employment output, an expansion is depicted by ________.

In the diagrams, AD1 and AS1 are the "before" curves. Assuming Q1 is full-employment output, an expansion is depicted by ________.

A. panel (A) only B. panel (B) only C. panel (C) only D. panels (A) and (B)

Because market price always tends back to the minimum average total cost for all identical firms in a perfectly competitive market in the long run, in theory:

A. the supply will remain a constant quantity. B. price will be the same at any quantity. C. the supply curve will be upward sloping. D. the supply curve may be downward sloping.

When a market is in surplus, there is pressure for the price to move upward

a. True b. False Indicate whether the statement is true or false

People in an open economy who wish to invest can either:

A. invest at home or abroad. B. buy stocks or bonds. C. invest in private companies or public companies. D. buy financial assets or durable goods.