A patent was purchased from a competitor for $50,000 cash on January 1 of this year. The patent has 10 years remaining in its legal life and will have value to the company for 4 years. The amortization entry for the year will require a credit to the Patent account for:

a. $12,500

b. $10,000

c. $5,000

d. $2,941

e. $1,250

a

You might also like to view...

Double-entry accounting requires that each transaction must be recorded

a. in only one account. b. None of answers listed c. in no more than two accounts. d. in at least two accounts.

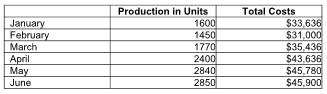

Using the high-low method, the total fixed costs are ________. (Round intermediate calculations to two decimal places, and the final calculation to the nearest dollar.)

Bernard Company shows the following manufacturing costs for the first six months of the year:

SMART goals are significant, mentored, attainable, reasonable, and timely

Indicate whether the statement is true or false

Election delays usually work in favor of employers for all of the following reasons except:

A. The union looks weak and unable to make progress against the employer. B. Union supporters may quit or be discharged. C. The employer gains more time to campaign against the union. D. The NLRB may decide that a union election is not feasible.