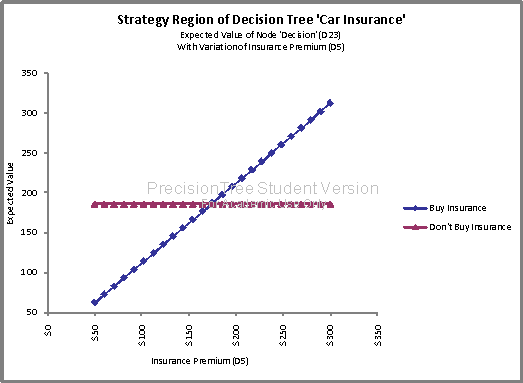

Using a strategy region graph, determine what impact, if any, the insurance premium cost has on her decision. Briefly explain your answer

If the insurance premium were to increase much above $175, Mrs. Rich would be better off not purchasing the collision insurance (see strategy region chart above), because the line for that alternative falls below (i.e. provides lower expected cost) the “Buy Insurance” line in that range. Above $175, the insurance premium is too expensive, relative to her risks.

You might also like to view...

Who purchases the company in an employee stock option plan?

a. private shareholders b. a legal entity composed of employees c. the employees d. a bank trust fund

A loss on disposal of a segment would be reported in the income statement as a(n)

A) administrative expense B) other expense C) deduction from income from continuing operations D) selling expense

The total amount of time companies use to take a customer order and deliver goods to a customer is referred to as the

A. order cycle. B. sales cycle. C. transaction route. D. procurement process. E. purchase process.

The internal rate of return may be defined as the:

A) percentage increase in the value of an investment over its useful life. B) the minimum return required by investors to hold a firm's securities. C) the discount rate at which a project's NPV is negative. D) the discount rate at which a project's NPV equals zero. E) the maximum rate of return expected from a project.