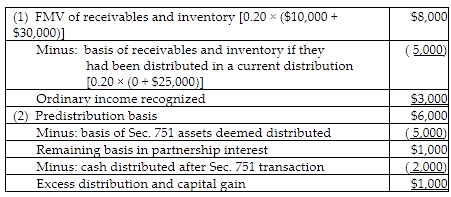

A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash. XYZ Partnership has no liabilities. His recognized gain is

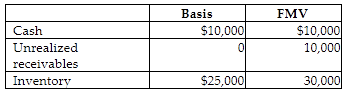

The XYZ Partnership owns the following assets on December 31:

A) $4,000 capital gain.

B) $3,000 capital gain and $1,000 ordinary income.

C) $3,000 ordinary income.

D) $3,000 ordinary income and $1,000 capital gain.

D) $3,000 ordinary income and $1,000 capital gain.

The partner's recognized gain is made up of two components: (1) the amount by which the proceeds of the deemed sale of the Sec. 751 assets (receivables and inventory) exceeds the basis for such property when received by the partner in a current distribution, and (2) the amount by which the remainder of the distribution exceeds the remainder of the partner's basis in the partnership interest.

You might also like to view...

Bill's gross pay for the week is $2150. His deduction for federal income tax is based on a rate of 25%. He has no voluntary deductions. His year-to-date pay is under the limit for OASDI. What is the amount of FICA tax that will be withheld from Bill's pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%. Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $537.50 B) $164.48 C) $701.98 D) $136.50

Profit maximization is the major focus of value engineering

Indicate whether the statement is true or false

A voidable contract is a contract that gives one of the parties the option of withdrawing from the agreement

Indicate whether the statement is true or false

The following data represent the number of refrigerators sold for each of the past five months for Templeton Appliances

Month Sales 1 25 2 20 3 40 4 35 5 30 Using a two-period simple moving average, the forecasting error for Month 3 is ________. A) 2.5 B) -5.0 C) -7.5 D) 17.5