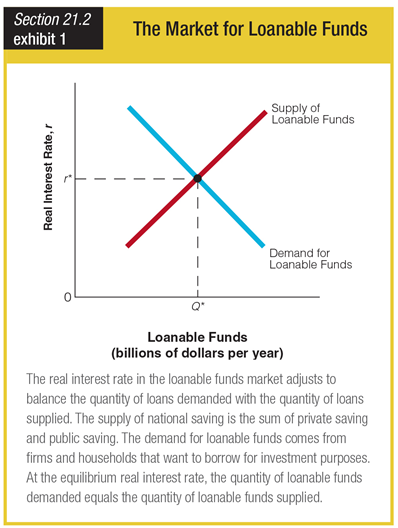

Based on the graph showing the market for loanable funds, what will happen at a real interest rate that is higher than equilibrium?

a. Lenders will compete for borrowers and interest rates will fall.

b. Lenders will compete for borrowers and interest rates will rise.

c. Borrowers will compete for loans and interest rates will fall.

d. Borrowers will compete for loans and interest rates will rise.

a. Lenders will compete for borrowers and interest rates will fall.

You might also like to view...

Government debt "crowds out" private investment because

A) the government and private firms compete in the same market for savings. B) private firms stop borrowing money when the government enters the market. C) the government's increased demand for loans decreases interest rates. D) the government can order the public to buy bonds.

The Fed can increase the federal funds rate by

A) buying Treasury bills, which increases bank reserves. B) selling Treasury bills, which decreases bank reserves. C) buying Treasury bills, which decreases bank reserves. D) selling Treasury bills, which increases bank reserves.

Refer to Figure 2-17. One segment of the circular flow diagram in the Figure shows the flow of funds from market F to economic agents G. The funds represent spending on goods and services. What is market F and who are economic agents G?

A) F = factor markets; G = households B) F = factor markets; G = firms C) F = product markets; G = firms D) F = product markets; G = households

The larger the fraction of an investment financed by borrowing

A) the greater the potential return and the smaller the potential loss on that investment. B) the smaller the potential return and potential loss on that investment. C) the greater the potential return and potential loss on that investment. D) the smaller the potential return and the greater the potential loss on that investment.