Identify and briefly discuss at least two examples of faulty oversight by a company's board of directors in corporate governance and/or the strategy-making, strategy-executing process.

What will be an ideal response?

Faulty oversight of corporate accounting and financial reporting practices by audit committees and corporate boards during the early 2000s resulted in the federal investigation of more than 20 major corporations between 2000 and 2002, leading to passage of the Sarbanes-Oxley Act in 2002. All too often, boards of directors have done a poor job of ensuring that executive salary increases, bonuses, and stock option awards are tied tightly to performance measures that are truly in the long-term interests of shareholders. As a consequence, the need to overhaul and reform executive compensation has become a hot topic in both public circles and corporate boardrooms, for example, weak governance at Fannie Mae and Freddie Mac allowed opportunistic senior managers to secure exorbitant bonuses, while making decisions that imperiled the futures of the companies they managed. Also, many boards have found that meeting agendas have become consumed by compliance matters, thus little time is left to discuss matters of strategic importance.

You might also like to view...

If an oral contract is declared to be unenforceable under the statute of frauds and one of the parties has rendered some performance under the contract that conferred benefits on the other party, he or she can recover the reasonable value of the performance on an express contract theory.

Answer the following statement true (T) or false (F)

Huang Company reported the following information for the current year: Sales$400,000 Average Operating Assets$250,000 Margin 10% The company's return on investment was:

A. 10%. B. 16%. C. 6.25%. D. Cannot be ascertained from the information provided.

Considering the following two-person game, the value of the game (if played many times) is

Y1 Y2 X1 6 3 X2 2 8 A) 19.00. B) 4.75. C) 4.67. D) Unable to be computed, as the ? was not given.

Use this information for questions that refer to the United Tools case.Terry Harter is marketing manager for United Tools, and Mike O'Reilly is the firm's logistics manager. They work together to make decisions about how to get United's hand and power tools to its customers-a mix of manufacturing plants and final consumers (who buy United tools at a hardware store). United Tools does not own its own transport facilities, and it works with wholesalers to reach its business customers.Together, Harter and O'Reilly try to coordinate transporting, storing, and product-handling activities to minimize cost while still achieving the customer service level their customers and intermediaries want. This usually requires that United keep an inventory of most of its products on hand; but demand for

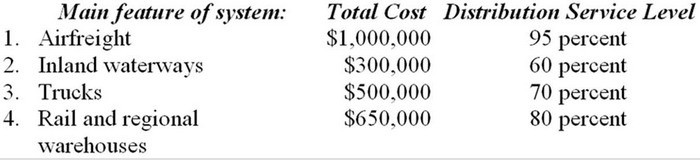

its products is fairly consistent over time, so inventory is easy to manage.Harter has identified four options for physical distribution systems she could use to reach two of her key wholesalers, Ralston Supply and Ricotta Tool Co. The total cost for each option-and the distribution service levels that can be achieved-are as follows: Ralston Supply expects a very high level (90 percent) of distribution customer service. Ricotta Tool Co. is willing to settle for a 70 percent customer service -leveleven if that means some products will occasionally be out of -stockif it gets products at a lower price.For its large retail hardware customers (like Home Depot), United regularly ships smaller orders directly to individual stores or in some cases to the retail chain's warehouses. Cross-country shipments usually go by rail, while regional shipments usually go by truck. United ships to the regional distribution centers of one of the retail hardware chains that it serves. The main advantage of the distribution centers for the retailer is likely to be that they

Ralston Supply expects a very high level (90 percent) of distribution customer service. Ricotta Tool Co. is willing to settle for a 70 percent customer service -leveleven if that means some products will occasionally be out of -stockif it gets products at a lower price.For its large retail hardware customers (like Home Depot), United regularly ships smaller orders directly to individual stores or in some cases to the retail chain's warehouses. Cross-country shipments usually go by rail, while regional shipments usually go by truck. United ships to the regional distribution centers of one of the retail hardware chains that it serves. The main advantage of the distribution centers for the retailer is likely to be that they

A. can store a larger inventory than in traditional warehouses.

B. speed the flow of tools from the factory to the stores.

C. eliminate the need for electronic communications between the distribution centers and the individual stores.

D. None of these is an advantage of distribution centers.