Explain why under the gold standard a perpetual surplus or a perpetual deficit is impossible

What will be an ideal response?

Since specie inflows drive up domestic prices and restore equilibrium in the balance of payments, any surplus eventually eliminates itself. A shortage of currency leads to low domestic prices and a foreign payments surplus, and any deficit eventually eliminates itself.

You might also like to view...

Suppose the Consumer Price Index is 143.6. What does that number mean?

A) On average, goods cost $143.60. B) On average, goods cost $243.60. C) Prices rose 143.6 percent over the reference base period, on average. D) Prices rose 43.6 percent over the reference base period, on average.

Refer to Figure 4-3. At the equilibrium price of P1, consumers are willing to buy Q1 pounds of granola. Is this an economically efficient quantity?

A) Yes, because marginal cost is zero at the price of P1. B) No, the marginal cost of the last unit (Q1 ) exceeds the marginal benefit of the last unit. C) Yes, because P1 is the price where marginal benefit equals marginal cost. D) No, the marginal benefit of the last unit (Q1 ) exceeds the marginal cost of that last unit.

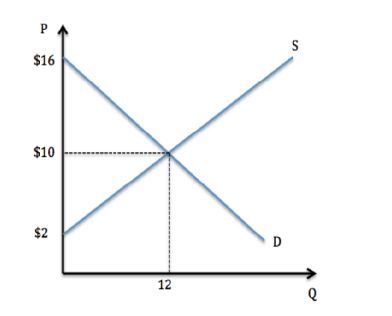

According to the graph shown, producer surplus is:

A. $36.

B. $48.

C. $120.

D. None of these.

Economists are fond of calculating measures of elasticity. If we calculate the income elasticity of money as the %?M / %?PY, where M is the quantity of money held and PY is nominal income, would you suspect the coefficient to be positive, negative or zero? Will the absolute value be greater or less than 1? Be sure to explain your choices.

What will be an ideal response?