Alexis has inherited $120,000 from her grandmother's estate. She has decided to invest $10,000 in each of 12 different industries

Because she has lower than average risk tolerance, she carefully seeks out stocks so that her portfolio will have a weighted average beta of .80.

A) Alexis is using traditional portfolio management techniques.

B) Alexis is using modern portfolio management techniques.

C) Alexis is using a combination of modern and traditional portfolio management techniques.

D) Alexis seems to be unaware of modern portfolio management techniques.

Answer: C

You might also like to view...

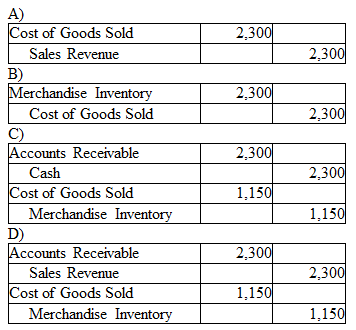

A company that uses the perpetual inventory system sold goods to a customer on account for $2,300. The cost of the goods sold was $1,150. Which of the following journal entries correctly records this transaction?

What are the types of supplementary material included in business reports?

What will be an ideal response?

Which step in the integrated strategic change process involves the organization’s vision and strategic choices about the amount of change that will be proposed in the new strategy?

a. Strategic analysis b. Strategy making c. Strategic change plan design d. Strategic change plan implementation

One of the preferences the Myers-Briggs Type Indicator uses to evaluate individuals is

A. conventional versus artistic. B. individualism-collectivism. C. masculinity-femininity. D. short-term versus long-term orientation. E. thinking versus feeling.