State and local taxes as a group seem to be mildly progressive, but federal taxes as a group seem to be mildly regressive.

Answer the following statement true (T) or false (F)

False

You might also like to view...

If the Federal Reserve System wanted to tighten the money supply, the most powerful combination of actions would be to

a. raise reserve requirements, lower the discount rate, and buy government securities. b. raise reserve requirements, lower the discount rate, and sell securities. c. lower reserve requirements, raise the discount rate, and buy government securities. d. raise reserve requirement, raise the discount rate, and sell government securities.

If a 10-year Treasury bond pays 3.1% and a 10-year corporate bond pays 7.4%, what is the interest rate spread on this particular corporate bond?

a. 4.3% b. 7.4% c. 10.5% d. 22.9%

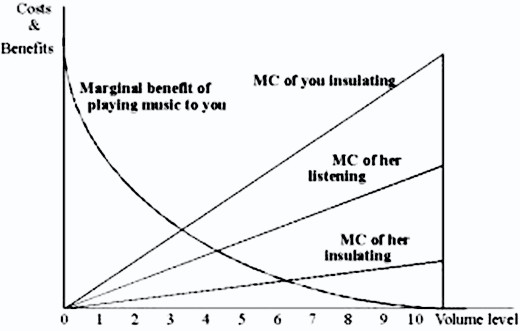

Suppose the problem is the stereo noise in the dorm. On the graph on the next page the amplifier dial numbers are located on the horizontal axis. The vertical axis measures the marginal costs and benefits of various levels of music (noise). Also measured on the vertical axis is the marginal cost of insulating the walls to prevent the externalities from penetrating the wall.  If negotiation costs are zero and you have the property rights to the airwaves, how loud will the music be played? The answer to the questions are to the nearest whole dial number.

If negotiation costs are zero and you have the property rights to the airwaves, how loud will the music be played? The answer to the questions are to the nearest whole dial number.

A. 6 B. 10 C. 4 D. 3

Knowing the price elasticity of demand is important in business because it allows a manager to determine whether:

A. a price increase will cause the quantity demanded to rise or fall. B. an increase in supply will cause total profit to rise or fall. C. a price increase will cause total revenue to rise or fall. D. a price increase will cause the demand to rise or fall.