Government shares in the gains to risk-bearing activities but does not _____

a. share in the losses when depreciation is straight-line

b. share in the losses when the investor has no other income

c. share in the losses when depreciation is accelerated

d. share in the losses when capital losses are allowed

b

You might also like to view...

What is a firm's short run supply curve?

Economists may hold many different views about the economy but on this they all agree: That price is always lower in a perfectly competitive market than in a monopoly market

Indicate whether the statement is true or false

Look at the following data: personal income = $4,900 billion; personal taxes = $900 billion; transfer payments = $980 billion. What is disposable income?

A) $3,200 billion B) $4,000 billion C) $4,980 billion D) $1,880 billion E) There is not enough information to answer the question.

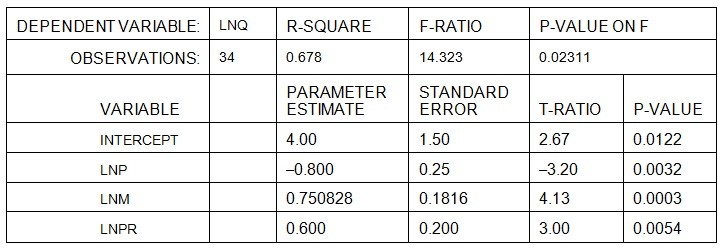

Build-Right Concrete Products produces specialty cement used in construction of highways. Build-Right is a price-setting firm and estimates the demand for its cement by the State Highway Department using a demand function in the nonlinear form:Q = aPbMc where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

height="198" width="577" />Given the above, if tax revenue per capita (M) increases 5%, the estimated quantity of cement demanded will A. increase more than 1% but less than 5%. B. increase more than 5% but less than 10%. C. increase by less than 1%. D. increase more than 10%.