You have invested $1,000 in a stock whose price is increasing at 10 percent a year. Your stock broker, who is never wrong, recommends a stock rising at 20 percent a year. Assuming the broker earns 4 percent of the stock’s value on any purchase or sale of the stock, should you take his or her recommendation?

What will be an ideal response?

You will earn $200 a year if you take the recommendation. This exceeds the opportunity cost: $100 forgone on the current stock, $40 to the broker when you sell the current stock, and $40 when you buy the new stock, for a total of $180. You gain $20 or 2 percent additional profit on your $1,000.

You might also like to view...

Discouraged workers

A) are considered part of the unemployed because they are not working. B) are not considered part of the unemployed because they quit their jobs voluntarily. C) are not considered part of the unemployed because they are not actively seeking work. D) are considered part of the unemployed because they are still in the labor force.

Refer to Figure 9.2. A movement from point a to point d could be caused by a simultaneous ________ and ________

A) decrease in taxes; massive crop failure B) increase in government spending; decrease in the price of oil C) increase in taxes; increase in the price of oil D) decrease in the money supply; decrease in government spending

If an estimated regression explains none of the variation, R2 will be

A) 0. B) between 0 and 1. C) 1. D) unable to determine with the information given.

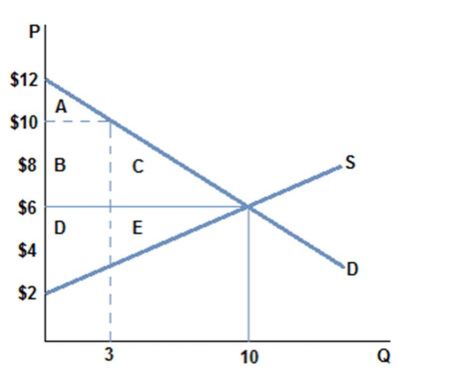

According to the graph shown, if the market goes from equilibrium to having its price set at $10 then:

A. $12 gets transferred from consumer surplus to producer surplus.

B. area C is lost consumer surplus due to fewer transactions taking place.

C. area E is lost producer surplus due to fewer transactions taking place.

D. All of these are true.