A company that issues debt securities paying a fixed return would be defined by the Investment Company Act as a(n):

a. face-amount certificate company b. unit investment trust

c. management company d. "no load" company

e. none of the other specific choices are correct

a

You might also like to view...

Greene Creations, a popular furniture manufacturer, provides employee support through various workshops on interior design techniques. It also offers three-month courses on various aspects of decorating a home, from suitable paint for a media room to contemporary outdoor furnishings. This adds to employees' existing knowledge and skill sets, helping create customer satisfaction. In this scenario, which approach to employee development is Greene Creations taking?

A. job experiences B. counseling C. interpersonal relationships D. formal education E. assessment

After a company has chosen a channel system, it must select, train, motivate, and evaluate individual

intermediaries for each channel. Indicate whether the statement is true or false

When the auditor reconciles the program version numbers, which audit objective is being tested?

a. protect applications from unauthorized changes b. ensure applications are free from error c. protect production libraries from unauthorized access d. ensure incompatible functions have been identified and segregated

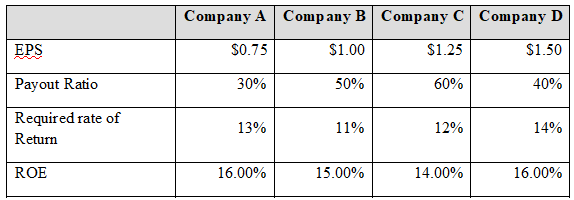

The following table contains information about the estimated next year’s EPS, payout ratio, shareholders’ required rate of return, and return on equity of four different companies:

a) Calculate each company’s future earnings growth rate. Using the earnings model, what is the value of the stock?

b) Using the constant-growth dividend discount model, what is the value of the stock?

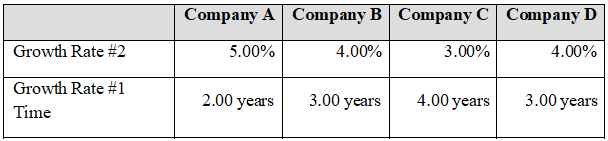

c) Assume that the companies will experience the growth rate determined in part (a) for a short period of time, and after that the firms will grow at a lower rate. These periods of time and second growth rates are the following:

Using the two-stage dividend growth model, what is the value of the stock? Calculate your solution twice, first using equation 9-5 on page 260, and then using the FAME_TwoStageValue function.

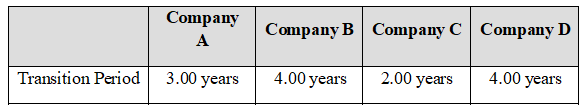

g) Assume that the transition between growth rates 1 and 2 will be gradual rather than instantaneous. The forecasted transition periods are the following:

Using the H model, what is the value of the stock? Calculate your solution twice, first using equation 9-8 on page 264, and then using the FAME_HModelValue user-defined function.

h) Create a Scatter chart to show the relationship between the value of the stock and the dividend payout ratio using Company D. Can you observe any price that is extremely different from the rest? Interpret your results.