If the government wishes to increase its spending on goods and services by $10 billion without increasing the overall level of aggregate demand, it should

a. increase taxes by $10 billion.

b. decrease taxes by $10 billion.

c. increase taxes by more than $10 billion.

d. increase taxes, but by less than $10 billion.

e. leave tax receipts unchanged.

C

You might also like to view...

Profit maximization is

A. the only motive of any firm’s management. B. a behavioral assumption to simplify analysis. C. the same as satisficing. D. a literal description of a firm’s behavior.

The total tariff revenue to the government of an imported good is found by adding the tariff to the quantity of the good imported

a. True b. False Indicate whether the statement is true or false

Local property taxes are a

A. Progressive tax because the total tax on housing increases as the price of the house increases. B. Progressive tax because as income increases people tend to buy more expensive houses. C. Regressive tax because poorer people spend a larger portion of their income on property taxes. D. Proportional tax because properties are taxed at the same rate regardless of the value of the home.

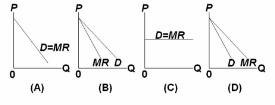

Which of the diagrams correctly portrays the demand (D) and marginal revenue (MR) curves of a pure monopolist that is able to price discriminate by charging each customer his or her maximum willingness to pay?

A. A.

B. B.

C. C.

D. D.