The formula for computing a basic price index is

A. (100/cost of market basket in base year) + cost of market basket today.

B. (cost of market basket today/cost of market basket in base year) × 100.

C. (cost of market basket in base year/100) × cost of market basket today.

D. (cost of market basket in base year/cost of market basket today) × 100.

Answer: B

You might also like to view...

A straight-line demand curve with negative slope intersects the horizontal axis at 100 tons per week. At the midpoint on the demand curve (corresponding to 50 tons per week) the price elasticity of demand is

A) 0. B) 0.5. C) 1.0. D) unknown without more information.

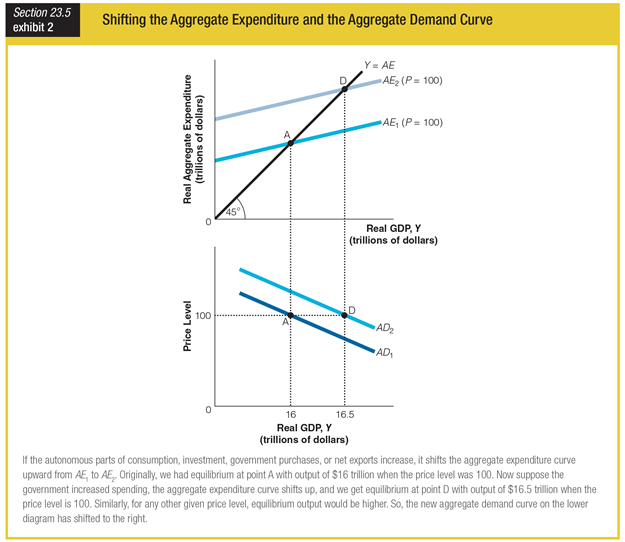

Assume the economy is at point D. What would happen to AD2 and the point of equilibrium if P increased to 110 while the autonomous parts of consumption, investment, government purchases, and net exports remained constant?

a. AD2 would shift right, and the point of equilibrium would move right.

b. AD2 would shift left, and the point of equilibrium would move left.

c. AD2 would not move, but the point of equilibrium would move left.

d. AD2 would not move, but the point of equilibrium would move right.

Suppose that there are only two countries, the U.S. and Japan. If real interest rates rise in Japan, which of the following is NOT true?

A) More Japanese yen will be supplied in exchange for dollars. B) More U.S. dollars will be supplied in exchange for yen. C) The volume of yen traded will increase. D) Japanese borrowers will be worse off.

The average expected rate of return of a financial asset equals:

A. the rate that compensates for time preference plus the rate that compensates for risk. B. the rate that compensates for time preference plus the rate of inflation. C. beta plus the rate that compensates for risk. D. the risk-free interest rate plus the rate of inflation.