What are the four types of industry structures? Compare and contrast them with the number of firms in the industry, whether firms produce homogeneous or heterogeneous products, whether there are economic profits in long-run equilibrium, and how frequently the model appears in the real world.

What will be an ideal response?

The four types are perfect competition (many firms, homogeneous products, zero economic profits in long-run equilibrium, rare—or nonexistent—in the real world), monopolistic competition (many firms, heterogeneous products, zero economic profits in long run, very common in the real world), oligopoly (few firms, homogeneous or heterogeneous products, zero or positive economic profits in the long run, very common in the real world), and monopoly (only one firm, differentiated product, positive long-run economic profits, relatively uncommon in the real world, but it depends on the definition of the product and the market).

You might also like to view...

We are investigating the relationship among three variables. We have graphed two of them. Suppose that the variable that is not measured on the x-axis or the y-axis changes. Then, there is

A) no impact on the plotted curve because the variable is not measured on either of the axes. B) a violation of the absence of trend assumption. C) a shift in the plotted curve. D) a movement along the plotted curve. E) an omitted variable.

The Fed classifies different types of money depending on its:

A. liquidity. B. resale value. C. commodity back. D. intrinsic value.

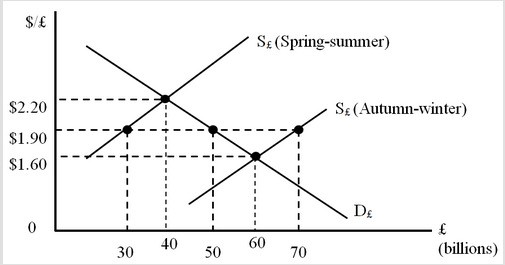

The figure below shows the foreign exchange market. D£ is the nonofficial demand curve for pounds. S£ (Spring-summer) and S£ (Autumn-winter) are the nonofficial supply curves of pounds during the spring-summer and autumn-winter seasons, respectively. In the Spring-summer period, what is the social gain if the British government maintains a fixed exchange rate at $1.90 per pound?

A. 3 billion dollars B. 3 billion pounds C. 10 billion pounds D. 6 billion dollars

Fiscal policy is enacted through changes in:

A. Interest rates and the price level B. The supply of money and foreign exchange C. Unemployment and inflation D. Taxation and government spending